Taxpayers are preparing for the annual filing deadline, and (hopefully) keeping a keen eye out for potential tax scams. Many may be looking for a little more help, or time, to complete their federal returns safely and efficiently.

REAL ID deadline is weeks away. Here’s what you need to know.

And for those who find themselves knocking on the door of Tax Day (that would be Tuesday, April 15) without a completed return — whether due to procrastination, an exceptionally complicated tax year, or even a natural disaster — the federal government can offer some assistance.

How do tax extensions work?

For taxpayers unable to complete and file their taxes by the federal deadline, the IRS will grant a partial year extension to submit required documents and have your taxes approved by the IRS. Individuals won’t receive any marks against them for requesting an extension (in fact, it’s much better to extend than file your return late) but it may affect how much you end up owing the federal government in the long run. More on that later.

Tax extensions may also be automatically granted to individuals with extenuating circumstances, such as those serving in a combat zone or hazardous duty area, taxpayers living outside the United States, and people living in disaster areas.

Currently, all Tennessee residents have been granted an extension to Nov. 3. Residents of Alabama, Florida, Georgia, North Carolina, and South Carolina have to file by May 1. Residents in various counties across Alaska, California, New Mexico, South Carolina, and Virginia have also been given tax-filing extensions.

How do I request an extension?

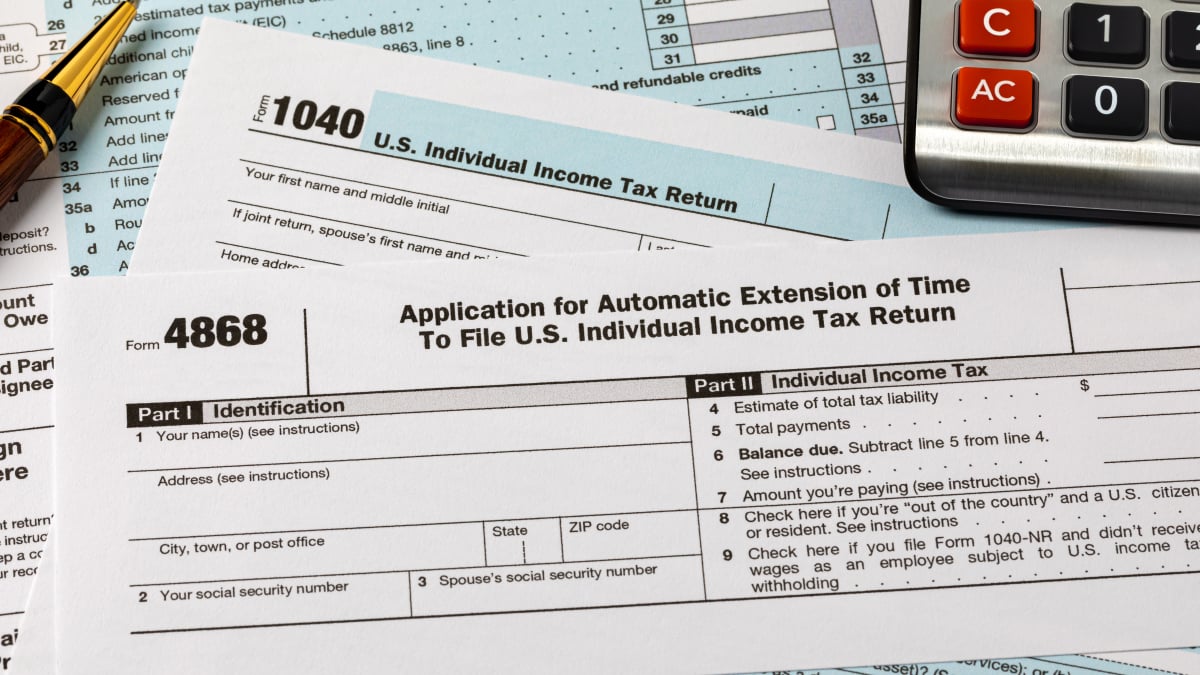

In order to request an extension, taxpayers must fill out a 4868 Form, also called the “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.”

Mashable Top Stories

You can fill out a 4868 form through the tax software of your choice, including any of the federal free file options, or mail in a physical copy of the filled-out form to the IRS before the due date. Search for or select a 4686 form when prompted as you are filing your taxes.

Taxpayers can also request an extension when paying an estimated tax bill, indicating their extension request in the payment details, according to the agency. The IRS recommends making an electronic payment before filing if you have a general sense of the amount of taxes you may owe after filing, in order to avoid additional penalties.

What is the deadline to file for an extension?

Extension requests must be submitted before Tax Day, April 15.

Will I owe more money if I file for an extension?

Tax-filing extensions do not apply to paying any taxes you owe. That means that any owed taxes will begin accruing penalties after Tax Day, including 5 percent interest on what you owe each month, up to 25 percent. Late payment fees are typically 0.5 percent of what you owe each month, up to 25 percent.

If you are unable to pay the full amount at the time you file, you may request a short or long term payment plan, instead. Penalties accrued may be lessened on a payment plan, according to the IRS.

If you don’t expect to owe any money but anticipate receiving a refund, that amount won’t be affected by filing under an extension.

What do I do after I’ve requested an extension?

It’s easy, just file those taxes! Taxpayers who are granted extensions have 6 months to file. That puts your new deadline at Oct. 15, 2025.